- +91 7041340308

-

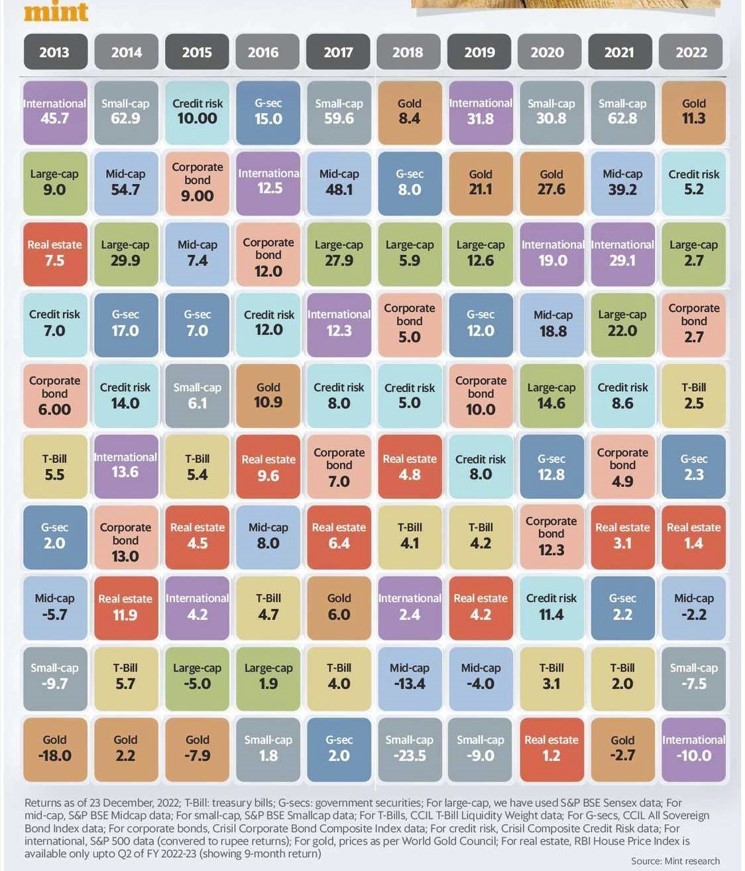

Asset classes behave differently every year. Our goals are to achieve in a finite time. We conduct annual and quarterly reviews of investor portfolios. We use an annual portfolio review as a way to check up on your portfolio—and potentially make some changes—within the context of your well-thought-out plan. Even if you haven’t actively made changes to your portfolio mix, the contents of your portfolio may have shifted.

The primary objective of portfolio rebalancing is to establish better risk control, and ensure that your portfolio isn’t singularly dependent on the success or failure of a particular investment, asset class, or fund type.

Rebalancing works as a risk-minimizing strategy for you as an investor. It allows you to line up your investment with your goals by periodically rebalancing your portfolio. If your risk tolerance or your investment strategies change, then you can rebalance the weight of the asset class in your portfolio by reassessing and devising a new asset allocation.

When you invest in mutual funds, you are investing to achieve a single goal via various vehicles. So when you rebalance, the shift must occur across all of these funds at the same time.

Here’s how you can rebalance your portfolio in 5 simple steps:

Step 1: Primarily, have an asset allocation plan by considering your income, the expected time of retirement, and so on. Create an asset allocation framework, but if you are unsure speak to an expert – Safe Assets can be of help here.

Step 2: Assess your current asset allocation by identifying where and how your current investments are placed in stocks, cash, bonds, or any other form of investment. After this, make a comparative analysis of asset allocation target and its present state and make adjustments accordingly.

Step 3: Chart out a rebalancing plan is your asset allocation target does not align with your current portfolio. This step can be tricky where you have to decide on the securities to retain and in what numbers. Speak to our experts at Safe Asset to get clarity.

Step 4: Be mindful of the tax implications, especially on capital gains. Avoid the short term taxes on capital gains by holding on to your equities for over a year. In the case of debt funds, the short-term capital gains will qualify for taxes based on the individuals’ income tax slab. For long-term capital gains, the tax is 20% with indexation. If you need to scale back, aim to sell the securities in the tax-exempt accounts first. In this way, you can limit the taxes you pay in capital gains.

Step 5: Review your portfolio at least once a year or maybe once in six months to assess your position but rebalance it only when you feel that the allocations are significantly out of the track to reaching the target.

Vivek Nagpal is an ace personal financial professional. He has more than 18 years of experience across banking, broking & mutual funds. He has worked with large institutions managing public & institutional money.

221-222 Nexus, Nr Spring

Retreat IV, Off Vasna Bhayli

Road. Vadodara 390007.

Gujarat

+91 7041340308

Copyright © Vivek Finserve. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-248973 | Date of initial registration – 01-Feb-2023 | Current validity of ARN – 31-Jan-2026

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors