- +91 7041340308

-

A substantial corpus creation for one’s retirement phase is an essential aspect to take care of during financial distributor. It not only allows individuals to fulfill their expenditure requirements but also allows them to sail through their post-retirement life with the least hassles.

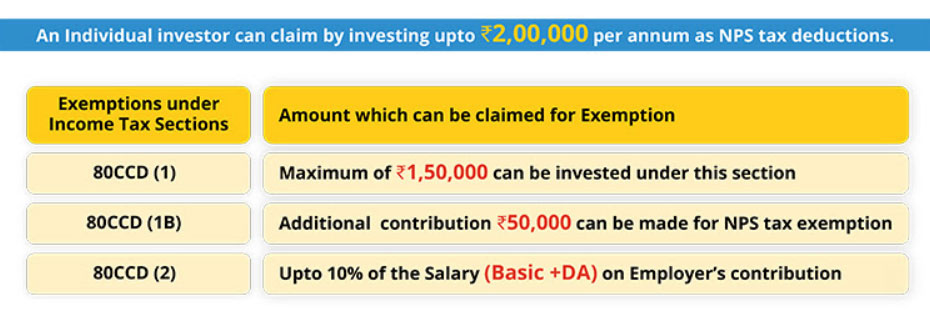

To address this concern of the growing senior citizen demography in the country, the Indian Government thus introduced schemes like the National Pension Scheme or NPS. The scheme allows for systemized savings during one’s working years, thus inculcating a financial discipline among individuals to save for the future.

An initiative undertaken by the Government of India, the National Pension Scheme seeks to provide retirement benefits to all citizens of India, even from the unorganized sectors. Regulated and administered by the PFRDA or Pension Fund Regulatory and Development Authority under the PFRDA Act 2013, NPS is a defined, voluntary contribution scheme that is market-linked and managed by professional fund managers.

Contributions made by individual subscribers to a National Pensions Scheme under the system accumulate until retirement and corpus growth continues via market-linked returns. Subscribers also have an option to exit this plan before retirement or opt for superannuation. However, this scheme ensures that a part of savings is utilized to provide a subscriber with retirement benefits.

Thus, on retirement, exit, or superannuation, at least 40% of the contribution is utilized for the procurement of lifetime pension via the purchase of an annuity. The remaining funds are paid to the subscriber in a lump sum.

For a 22 year old, if 10,000 per month is contributed till 60 years, (i.e. next 38 years) it shall yield a corpus of 2.97 Cr (Considering 8% return ) and 40% amount is annuitized at the rate of 6%, which shall provide pension for an amount of approximately 60,000 per month.

Vivek Nagpal is an ace personal financial professional. He has more than 18 years of experience across banking, broking & mutual funds. He has worked with large institutions managing public & institutional money.

221-222 Nexus, Nr Spring

Retreat IV, Off Vasna Bhayli

Road. Vadodara 390007.

Gujarat

+91 7041340308

Copyright © Vivek Finserve. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-248973 | Date of initial registration – 01-Feb-2023 | Current validity of ARN – 31-Jan-2026

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors